美国总统拜登5月10日表示,白宫可能会取消特朗普任期对中国输美商品加征的部分关税,以平抑物价。白宫正在审查这些关税,并可能选择将其一并取消。本文作者认为,加征关税成本被转嫁给美国制造商和消费者,美国目前通胀持续高涨,而要想解决通胀问题,取消对中国商品加征的关税才是明智的选择。

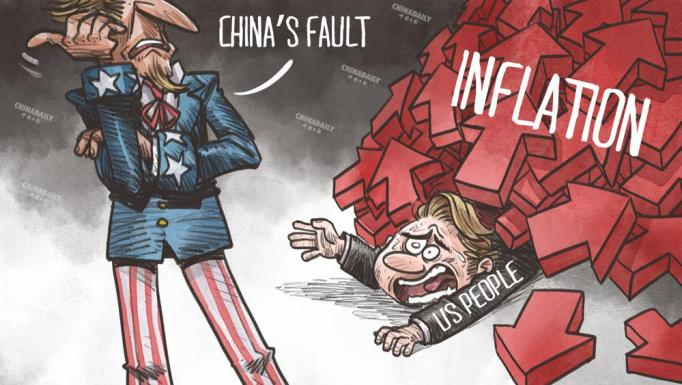

US President Joe Biden said on Tuesday that the White House could drop some of the Donald Trump-era tariffs on Chinese goods to lower consumer prices in the United States, according to CNBC. The White House is reviewing the tariffs, and could opt to lift them altogether.

据美国消费者新闻与商业频道报道,美国总统拜登5月10日表示,白宫可能会取消特朗普任期对中国商品加征的部分关税,以降低美国的消费价格。白宫正在审查这些关税,并可能选择将其一并取消。

There have been constant appeals by a large number of business leaders to reduce, if not altogether lift, the tariffs on Chinese goods, to help reduce skyrocketing inflation in the US. And senior US officials, including Treasury Secretary Janet Yellen and more than 140 Congress members, have been discussing the issue for some time now.

许多商界领袖不断呼吁取消或至少是减少对中国商品征收的关税,从而缓解美国飙升的通货膨胀率。包括财政部长珍妮特·耶伦和140多名国会议员在内的美国高官已经就该问题商讨了一段时间。

The consumer price index in the US broke the 7 percent mark in December 2021, the highest since 1982, and has continued to increase since the start of 2022, hitting 7.9 percent in February and 8.5 percent in March, forcing the Federal Reserve to raise interest rates by 50 basis points on May 4, the largest rate hike in 22 years. The CPI for April is 8.3 percent, somewhat abated, though still high.

2021年12月,美国消费者价格指数(CPI)突破了1982年以来的最高纪录7%,并自2022年初持续上涨,2月和3月分别达到7.9%和8.5%,这迫使美联储在5月4日加息50个基点,这是美国22年来最大幅度加息。4月份的CPI高达8.3%,但较之前有所下降。

A week before Biden's remarks, on May 3 to be precise, the US Trade Representative issued a notice on statutory four-year review of Section 301 tariffs on Chinese goods. It said that, according to the US Trade Expansion Act 1974, Section 301 tariffs on Chinese goods expire on July 6, so those that have benefited from the tariffs should submit their opinions on an extension before that date. If their requests are in favor of an extension, the tariffs will continue beyond July 6.

准确地说,在拜登发表讲话的前一周,即5月3日,美国贸易代表发布了一份关于根据“301条款”对中国商品加征关税的四年法定复审通知。声明称,根据美国《1974年贸易法》,对中国商品加征的“301关税”将于7月6日到期,因此那些受益于对华加征关税的美国国内行业代表应在该日期之前提交延期意见。如果他们支持延期,7月6日之后将继续征收这些关税。

The Trump administration had imposed tariffs on Chinese goods in steps. Hence, the statutory review for the rest of the tariffs will be completed only by Sept 1, 2023.

特朗普政府逐步对中国商品加征了关税。因此,其余关税的法定复审将在2023年9月1日之前完成。

If the White House follows that course, the reduction in tariffs will be too small, too late to help reduce inflation. Instead, the right choice would be to lift the tariffs altogether.

如果白宫遵循这一方针,关税削减规模太小,行动太迟,将无法帮助降低通胀。相反,正确的选择是完全取消这些关税。

First, the lifting of all the tariffs could quickly bring down the CPI in the US. A recent policy brief by the Peterson Institute of International Economies estimated that the removal of tariffs on Chinese goods including steel and aluminum could reduce the CPI by 1.3 percentage points.

首先,取消这些关税可能会迅速降低美国的CPI。彼得森国际经济研究所最近发布的一份政策简报预测,取消钢铁和铝等中国商品的关税可能会将CPI降低1.3个百分点。

The figure is close to that calculated by the Chinese government in a white paper issued in 2018. According to the white paper, the lifting of tariffs on low-cost imports from China will reduce the CPI in the US by 1 to 2 percentage points. Why? Because tariffs are paid by importers, not exporters, which in this case are US companies that pass the added cost down to the consumers, be they the downstream manufacturers or individual buyers.

这一数字与中国政府在2018年发布的白皮书中估算的数字接近。根据这份白皮书,对从中国进口的低成本商品取消关税将使美国的CPI降低1到2个百分点。这是为什么呢?因为关税是由进口商支付的,而不是由出口商支付的,在这种情况下,美国公司将增加的成本转嫁给消费者,无论是下游制造商还是个人买家。

A Moody's study has found that 92.4 percent of the added tariffs on Chinese imports are borne by the US side. And a joint study by the US-China Business Council and Oxford Economics found that tariffs on Chinese imports had reduced the US' GDP by $108 billion, or 0.5 percent, and household incomes by $88 billion in 2018-19.

穆迪公司的一项研究发现,美国对中国进口商品征收的附加关税中有92.4%由美方承担。美中贸易委员会和牛津经济研究院联合开展的一项研究发现,2018-2019年间,对中国进口商品征收关税使美国国内生产总值(GDP)减少0.5%,即1080亿美元(约合人民币7308亿元),家庭收入减少了880亿美元(约合人民币5955亿元)。

Second, the tariffs have been of virtually no use in checking Chinese exports to the US. According to China customs data, Chinese exports to the US hit an all-time high in 2021-$576.11 billion, up 20.4 percent over 2018, when the previous record was set before the effects of the tariffs were felt.

第二,这些附加关税在限制中国对美出口方面几乎毫无作用。根据中国海关数据,中国对美出口在2021年创下历史新高5761.1亿美元(约合人民币38975.6亿元),较2018年增长20.4%。2018年时加征关税的影响尚未显现。

Compared with 2020, Chinese exports to the US rose by 27.5 percent, more than that to ASEAN member states (26.1 percent) which didn't impose any additional tariffs on Chinese goods. Since the US tariffs have made no difference to bilateral trade, what is the rationale of keeping them?

与2020年相比,中国对美国的出口增长了27.5%,超过了对东盟成员国(26.1%)的出口增长,后者没有对中国商品征收任何额外关税。既然美国加征关税对双边贸易没有影响,那么为什么要保留关税呢?

And third, the US is obliged to follow international rules. A World Trade Organization panel found that the Section 301 tariffs violate the General Agreement on Tariffs and Trade clauses and are thus illegal. As a member of the WTO, the US has no excuse to continue with the tariffs, still less to keep using them as a bargain. In fact, the PIIE policy brief said the US should pursue trade liberalization to reduce inflation.

第三,美国有义务遵守国际规则。世界贸易组织的一个小组发现,“301关税”违反了《关税及贸易总协定》的条款,因此是非法的。作为世贸组织成员国,美国没有理由继续加征关税,更不用说继续将其作为一种讨价还价的手段。事实上,彼得森国际经济研究所政策简报称,美国应该追求贸易自由化以降低通胀。

Based on the three reasons, the correct choice for the Biden administration would be to swiftly lift all the added tariffs on Chinese goods. The move will result in three immediate benefits. It will help reduce the highest inflation in the US in 40 years, be a good gesture toward improving Sino-US trade relations, and a step in the right direction to show the US is back to following WTO rules.

基于这三个原因,拜登政府的正确选择是尽快取消对中国商品征收的所有附加关税。此举将带来三个立竿见影的好处:将有助于降低美国40年来最高的通货膨胀率;是改善中美贸易关系的一个良好姿态;也是表明美国重新遵守世贸组织规则,朝着正确方向迈出的一步。

The author is a senior fellow at the Center for China and Globalization.The views don't necessarily reflect those of China Daily.

本文作者何伟文是中国与全球化研究中心高级研究员。文章观点并不代表本网站立场。

编辑:董静

来源:中国日报